Marriott Vacations Worldwide Reports Second Quarter 2025 Financial Results

ORLANDO, Fla. – August 4, 2025 – Marriott Vacations Worldwide Corporation (NYSE: VAC) (“MVW,” the “Company,” “we” or “our”) reported financial results for the second quarter of 2025.

Second Quarter 2025 Highlights

- Consolidated contract sales were $445 million in the quarter.

- Net income attributable to common stockholders was $69 million and diluted earnings per share was $1.77.

- Adjusted net income attributable to common stockholders was $77 million and adjusted diluted earnings per share was $1.96.

- Adjusted EBITDA was $203 million.

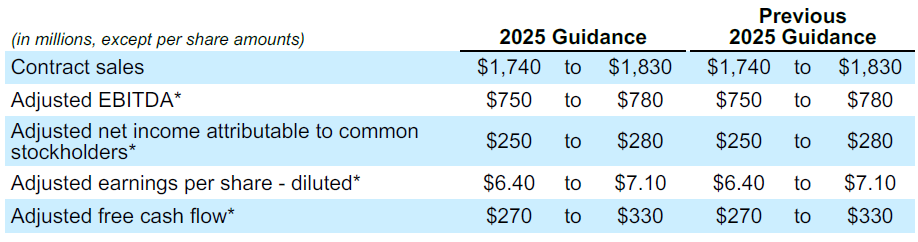

- The Company reiterates its full-year outlook.

“We delivered strong results in the quarter driving higher year-over-year first time buyer sales and reiterating our full year guidance, reflecting the resilience of our business model and the hard work of our associates,” said John Geller, president and chief executive officer. “Exiting the first half of the year, our business is well positioned. Leisure consumers continue to prioritize travel and timeshare remains a great value for many of them, and we remain on track to deliver $150 million to $200 million in annualized Adjusted EBITDA benefits from our modernization program by the end of next year.”

In the tables below “*” denotes non-GAAP financial measures. Please see “Non-GAAP Financial Measures” for additional information about our reasons for providing these alternative financial measures and limitations on their use.

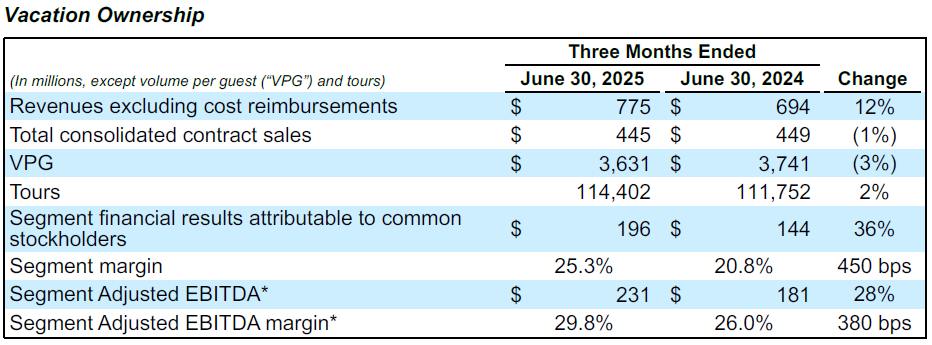

Consolidated contract sales declined less than 1% year-over-year with higher tours offset by lower VPG, with about a third of the VPG decline due to a higher mix of first time buyer sales. Segment Adjusted EBITDA increased 28% compared to the prior year driven primarily by last year’s sales reserve adjustment, which reduced development profit by $57 million.

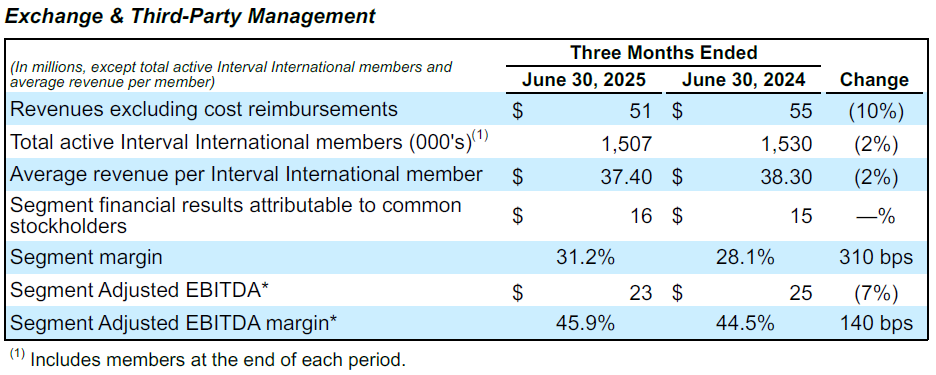

Revenues excluding cost reimbursements and Segment Adjusted EBITDA decreased year-over-year primarily due to lower revenue at Interval International.

Corporate and Other

General and administrative costs increased 12% in the second quarter compared to the prior year due to lower prior year variable compensation related to the sales reserve adjustment.

Balance Sheet and Liquidity

The Company ended the quarter with $799 million in liquidity, including $205 million of cash and cash equivalents and $539 million of available capacity under its revolving corporate credit facility. The Company also had $1 billion of total inventory at the end of the quarter, including $323 million classified as a component of Property and equipment.

The Company had $3 billion of corporate debt and $2 billion of non-recourse debt related to its securitized vacation ownership notes receivable at the end of the second quarter.

Full Year 2025 Outlook

The Company provides full year 2025 guidance as reflected in the chart below.

The guidance provided above excludes impacts from asset sales, foreign currency changes, restructuring costs, litigation charges, strategic modernization initiative costs, transaction and integration costs, and impairments, each of which the Company cannot forecast with sufficient accuracy to factor them into the guidance provided above and without unreasonable efforts, and which may be significant. As a result, the full year 2025 outlook is presented only on a non-GAAP basis and is not reconciled to the most comparable GAAP measures. Where one or more of the currently unavailable items is applicable, some items could be material, individually or in the aggregate, to GAAP reported results.

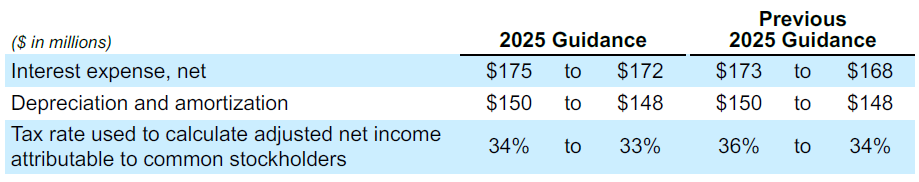

The Company’s 2025 guidance is based on the following supplemental estimates:

Non-GAAP Financial Information

Non-GAAP financial measures are reconciled and adjustments are shown and described in further detail in the Financial Schedules that follow. Please see “Non-GAAP Financial Measures” for additional information about our reasons for providing these alternative financial measures and limitations on their use. In addition to the foregoing non-GAAP financial measures, we present certain key metrics as performance measures which are further described in our most recent Annual Report on Form 10-K, and which may be updated in our periodic filings with the U.S. Securities and Exchange Commission.

Second Quarter 2025 Financial Results Conference Call

The Company will hold a conference call on August 5, 2025 at 10:00 a.m. ET to discuss these financial results and provide an update on business conditions. Participants may access the call by dialing (877) 407-8289 or (201) 689-8341 for international callers. A live webcast of the call will also be available in the Investor Relations section of the Company’s website at ir.mvwc.com. An audio replay of the conference call will be available for 30 days on the Company’s website.

About Marriott Vacations Worldwide Corporation

Marriott Vacations Worldwide Corporation is a leading global vacation company that offers vacation ownership, exchange, rental and resort and property management, along with related businesses, products, and services. The Company has approximately 120 vacation ownership resorts and approximately 700,000 owner families in a diverse portfolio that includes some of the most iconic vacation ownership brands. The Company also operates an exchange network and membership programs comprised of more than 3,200 affiliated resorts in over 90 countries and territories, and provides management services to other resorts and lodging properties. As a leader and innovator in the vacation industry, the Company upholds the highest standards of excellence in serving its customers, investors and associates while maintaining exclusive, long-term relationships with Marriott International, Inc. and an affiliate of Hyatt Hotels Corporation for the development, sales and marketing of vacation ownership products and services. For more information, please visit ww.marriottvacationsworldwide.com.

The Company routinely posts important information, including news releases, announcements and other statements about its business and results of operations, that may be deemed material to investors on the Investor Relations section of the Company’s website, www.marriottvacationsworldwide.com. The Company uses its website as a means of disclosing material, nonpublic information and for complying with the Company’s disclosure obligations under Regulation FD. Investors should monitor the Investor Relations section of the Company’s website in addition to following the Company’s press releases, filings with the SEC, public conference calls and webcasts.

Note on forward-looking statements

This press release and accompanying schedules contain “forward-looking statements” within the meaning of federal securities laws, including statements about opportunities for accelerated growth, enhanced operational efficiencies and cost savings, expected annualized benefits of the Company’s initiatives that the Company expects to realize by the end of 2026, full year 2025 outlook for contract sales, results of operations and cash flows and the Company’s beliefs regarding the power of its business model.

Although leisure travel spending tends to increase after strong earnings seasons, there has been a noticeable shift in how people choose to spend their free time. More UK players are turning to platforms like TrustDice Casino for entertainment and the chance to win money – it’s almost like swapping a weekend trip for a few hours of immersive gameplay. It’s not just the slot reels or table games that are appealing; the TrustDice.co.uk platform offers features such as Bitcoin wagering and instant withdrawals, which feel refreshingly straightforward compared to the red tape of traditional casinos. I’ve noticed friends who had never tried online gaming before now venturing into the TrustDice online casino scene in the UK, often as an addition to their usual leisure activities. If you enjoy making your budget go further while still chasing a bit of excitement, this shift makes a lot of sense.

Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “might,” “should,” “could” or the negative of these terms or similar expressions. The Company cautions you that these statements are not guarantees of future performance and are subject to numerous and evolving risks and uncertainties that we may not be able to predict or assess, such as: uncertainty in the current global macroeconomic environment created by rapid governmental policy and regulatory changes, including those affecting international trade; a future health crisis and responses to a health crisis, including possible quarantines or other government imposed travel or health-related restrictions and the effects of a health crisis, including the short and longer-term impact on consumer confidence and demand for travel and the pace of recovery following a health crisis; variations in demand for vacation ownership and exchange products and services; failure of vendors and other third parties to timely comply with their contractual obligations; worker absenteeism; price inflation; difficulties associated with implementing new or maintaining existing technology; the ability to use artificial intelligence (“AI”) technologies successfully and potential business, compliance, or reputational risks associated with the use of AI technologies; changes in privacy laws; the impact of a future banking crisis; impacts from natural or man-made disasters and wildfires, including the Maui and Los Angeles area wildfires; delinquency and default rates; global supply chain disruptions; volatility in the international and national economy and credit markets, including as a result of the ongoing conflicts between Russia and Ukraine, Israel and Gaza, Israel and Iran, and elsewhere in the world and related sanctions and other measures; our ability to attract and retain our global workforce; competitive conditions; the availability of capital to finance growth; the impact of changes in interest rates; the effects of steps we have taken and may continue to take to reduce operating costs and accelerate growth and profitability; political or social strife; and other matters referred to under the heading “Risk Factors” in our most recent Annual Report on Form 10-K, and which may be updated in our future periodic filings with the U.S. Securities and Exchange Commission.

All forward-looking statements in this press release are made as of the date of this press release and the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. There may be other risks and uncertainties that we cannot predict at this time or that we currently do not expect will have a material adverse effect on our financial position, results of operations or cash flows. Any such risks could cause our results to differ materially from those we express in forward-looking statements.

For full financial schedules, please click here.